OFFSET

Trading

OFFSET TRADING ALLOWS THE TRADER TO MATCH TRADE ACTIVITY WITH ENVIRONMENTAL PLEDGES.

This feature gives the trader or broker the option to commit to environmental pledges relative to the volume traded. Traders can select a pledge, the more they trade the greater the contribution to the pledge.

Traders can track their own impact automatically. Allowing them to keep up to date with the benefits their trading is contributing.Depending on how offset trading is configured – it does not need to impact the cost of trading.

Environmental pledges include:

Picking up ocean plastic

Reforesting rainforest

Planting coral

USER JOURNEY EXPLAINED

-

Allow your trader to select from a number of important environmental issues

-

Offset trading will track the volume and value of trade activity

-

Monthly payments relating to trade volumes will be made to the selected pledge

-

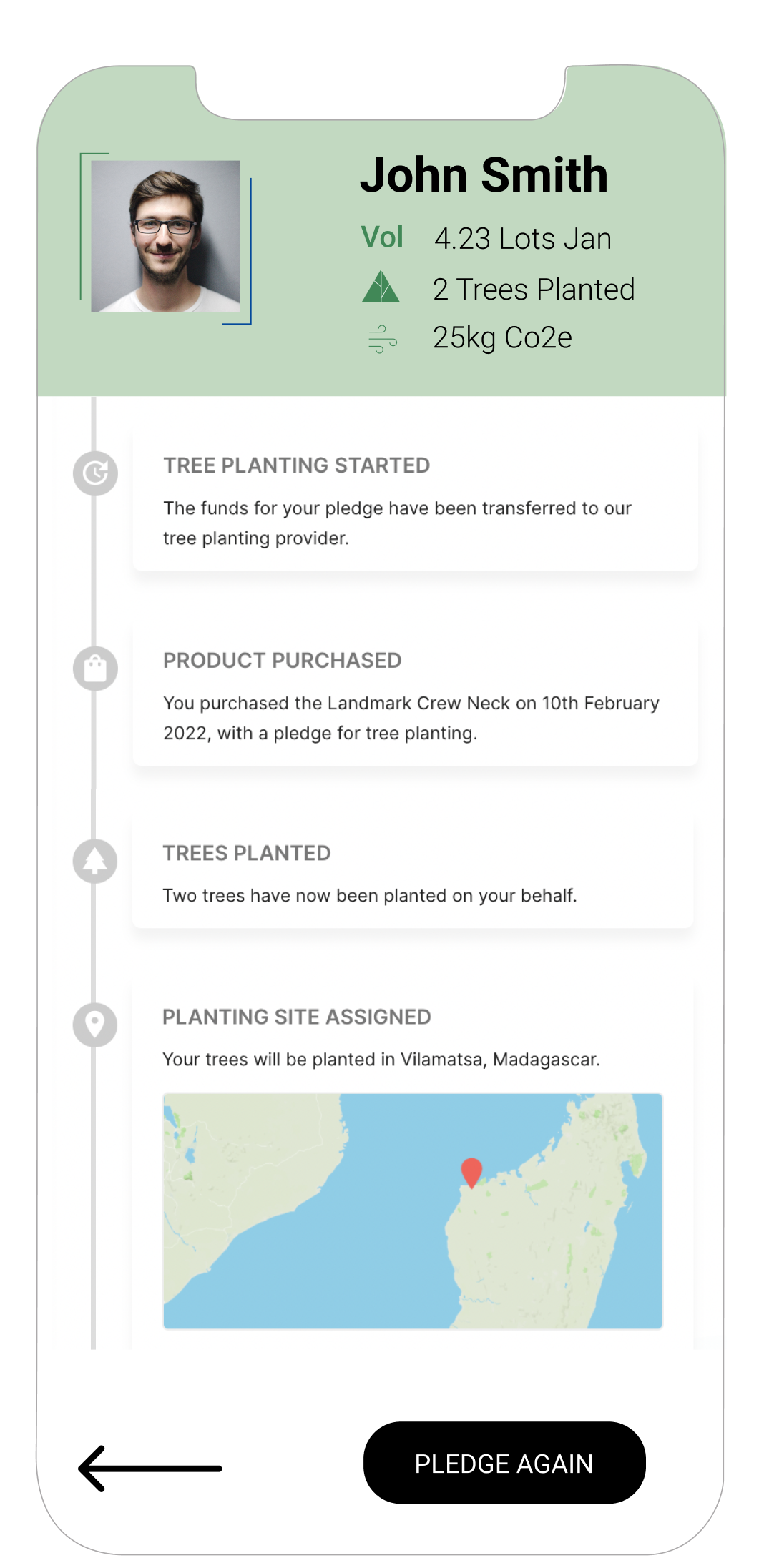

Impact tracking can automatically tell the story of the traders impact

WHO PAYS FOR THE PLEDGE?

Offset trading is a customisable tool allowing any combination of broker, trader or even Pelican (us) to make the contributions to the pledges. Payments to pledges are volume related. The greater the volume the greater the contribution to the pledge.

WHO PAYS FOR THE PLEDGE?

Offset trading is a customisable tool allowing any combination of broker, trader or even Pelican (us) to make the contributions to the pledges. Payments to pledges are volume related. The greater the volume the greater the contribution to the pledge.

HOW DOES IT WORK?

Offset trading is a standalone feature available via API that can be integrated into any user on-boarding journey. Traders are not forced to commit – they are provided with the option to support a pledge important to them. Offset trading is also available as a service within Pelican’s white label copy trading platform.

WHY DO YOU NEED THIS FEATURE?

Offset trading is useful for a number of reasons:

- Encourages trading activity

- Identifies your brand commitment to sustainability

- Expands the appeal of trading to a wider younger audience

- But most importantly…..it does good for the planet